Use your investor voice.

Many of us have stocks among our investments (especially in IRAs, SEPs or other retirement accounts). That makes us shareholders who can express our voices.

Literally, vote – on Directors and resolutions

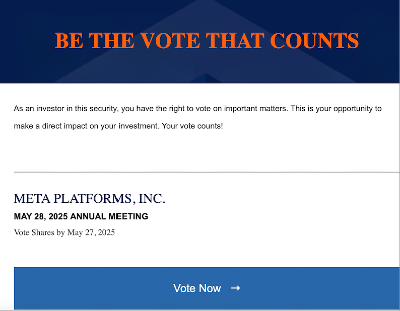

Publicly-owned companies have to put their officers and different kinds of resolutions to a vote by their shareholders. If you've ever gotten an email or paper mailing that looks like this, you've had an opportunity to vote:

For recommendations on specific companies and issues, ICCR (the Interfaith Center on Corporate Responsibility) maintains a list of companies and recommended votes at https://www.iccr.org/vote-your-proxies-see-2025s-proxy-memos-and-exempt-solicitations/.

Most of us don't exercise that vote, but it can matter:

- Voting with management gives them more ammunition to resist efforts to roll back protections. For example, when Disney was faced with a resolution urging them to back away from their DEI commitments, management's intention to hold the line were bolstered when 99% of shareholders voted against the proposal.

- Voting against management can send a signal, whether voting on a resolution or for management's choices for the Board of Directors. Even if management wins a vote, a strong vote against them is noted by institutional investors who may push management on those topics.

For a great explanation, see:

Vote Your Shares! Big or small, if you have investments you can send a loud and proud message | GLAAD

By Christina O’Connell If you own stocks in your retirement or investment accounts, annual meeting notices will fill your inbox each spring – and if you’re like most of us, you likely don’t pay them much attention. These notices or “proxy statements” are pretty dense documents, providing financial results and more but they are also